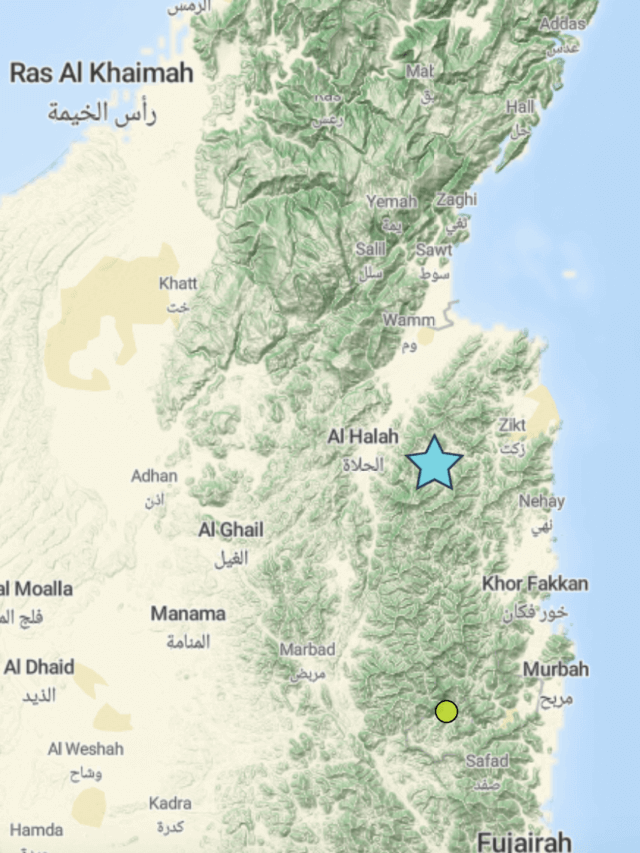

After high-impact weather alerts, the recent Rain Disaster in the states of UAE caused significantly more damage than expected.

Most of these claims would probably include damaged autos due to the destructive nature of the storm. In such a case, the insurance will pay for it.These claims could be extremely specific or quite general. A “total loss” vehicle differs from a “claims process” vehicle in terms of the severity of the damage.

Many cars have broken down in the United Arab Emirates, and technicians and garage owners are struggling to keep up with the demand. Some drivers may have to pay as much as Dh40,000 for repairs after having their insurance claims denied.

Damage from the Rain Disaster that hit the UAE on April 16 left many drivers with stalled vehicles and high repair expenses. There is cause for worry since many people may have trouble obtaining insurance for the flood-damaged automobiles, and thousands of vehicles may need costly repairs.

“If the damage is severe, certain car parts require expensive imports from the vehicle’s country of origin. The floods may have damaged critical components such as the electrical circuit and engine. Water may have entered the engines leading to hydrolock, transmission failure, and engine breakdown,” According to Rajappan, Co-owner of Car Lynx garage.

Automobile experts highlighted that only after conducting extensive diagnostics and testing can they estimate the cost of repair. The vehicle’s make, damaged parts, replacement of spare parts, and the amount of time needed to fix it can all affect the cost of repairs.

“These damages are not only costly but also pose logistical challenges, with recovery trucks fully booked and garages at maximum capacity,” said Rajappan.

The insurance company of the careless driver often pays to have the damages of the other vehicles covered in a multi-vehicle collision. Towing a fully insured vehicle to a garage from a designated parking spot usually results in the insurance company paying for the repairs.

Cars parked in wet or partially flooded regions may have their insurance claims refused if someone tried to start the engine and damaged the car. However, insurers do not have the right to recover damages in cases involving natural disasters.